Dialogue with Daniel Yergin: China-U.S. energy cooperation, divergence & future of AI

S&P Global's Vice Chairman tells China's top energy thinker why the U.S. transition is market-driven, not ideological, and identifies LNG as a path for cooperation.

Happy Holidays & A Quick Look Back at 2025

Before we get to today's issue, I want to wish every reader a joyous holiday season. Wherever you are, I hope you and your loved ones have a happy, healthy, and prosperous New Year.

I also want to say a heartfelt thank you for your support throughout 2025. Every subscription, like, and share really keeps this newsletter going. The whole goal here is to make China a little more "readable," and I hope I've been able to do that for you this year.

One last thing: If you're looking for some holiday reading, I've linked my Top 3 most-popular posts of 2025 at the very bottom of this issue. Check them out if you missed them the first time around!

Basic Intro of Today's Issue

Today's newsletter features a conversation between Mr. Daniel Yergin, a world-renowned energy strategic thinker and Vice Chairman of S&P Global, and Dr. Lu Ruquan (陆如泉), president of the Economics & Technology Research Institute at China National Petroleum Corporation (CNPC ETRI), the only one among China's 29 nationally recognized elite think tanks dedicated to energy.

This exchange took place at the International Energy Executive Forum 2025 from Dec. 11 to 12.

The Speakers

Mr. Daniel Yergin served as the U.S. presidential energy advisor from 1993 to 2021 and now the Vice Chairman of S&P Global. He won a Pulitzer Prize for his seminal book, The Prize: The Epic Quest for Oil, Money, and Power. Mr. Yergin also founded CERAWeek, an annual gathering described by the Financial Times as "the Davos of energy."

Dr. Lu Ruquan 陆如泉 leads the Economics & Technology Research Institute at China National Petroleum Corporation (CNPC ETRI). Holding dual degrees in Petroleum Engineering and English, as well as a PhD in International Relations, Dr. Lu is a veteran of CNPC’s projects in Iraq and Sudan. Since 2006, he has devoted himself to strategic management and policy analysis.

Conversation Highlights

This dialogue covers macro policy, industry pain points, and future variables. Key takeaways include:

China vs. U.S. Strategy: The two discuss the divergence in energy strategies between the two countries over the coming decade. Yergin introduces the concept of "Energy Dominance," noting that the U.S. strategy is driven by resource endowment (oil & gas) and market costs, rather than ideology. "If the cost is low enough, the U.S. will use solar, too."

Potential Cooperation: Yergin suggests that if U.S.-China trade friction can be resolved in a way, there is significant potential for cooperation in the LNG sector.

Security Over Transition: Acknowledging the vulnerability of the U.S. power grid, Yergin notes that coal plants are being retained due to fears over system stability. This indicates a global trend: the priority of energy security is once again overriding energy transition.

The AI Energy Crunch: On the topic of AI, Yergin notes that U.S. tech giants are less worried about innovation and more worried about power. The rise of ChatGPT has forced companies to re-embrace baseload power sources to meet massive computational energy demands.

Please note the transcript below was originally published in Chinese by Dr. Lu on his personal WeChat account. The English text provided here is a translation based on that Chinese record and is not a verbatim transcript of Mr. Yergin’s original English remarks. Dr. Lu has kindly authorized the translation.

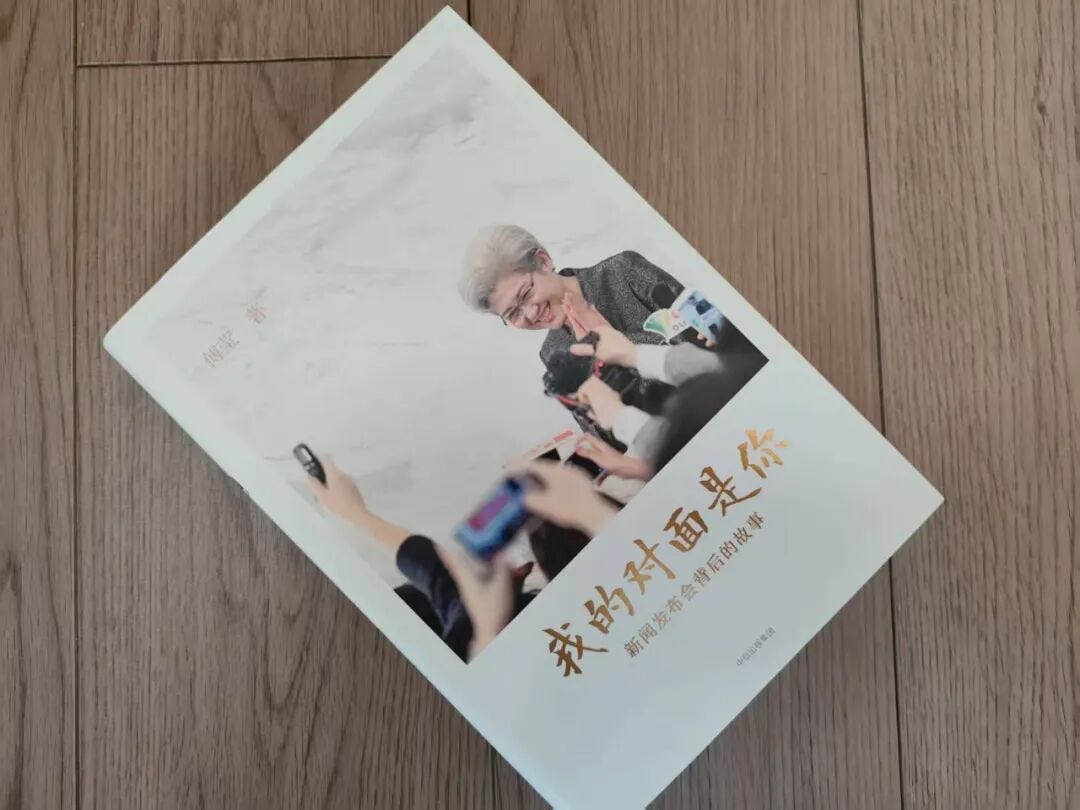

“我的对面是你”:记录一场与丹尼尔·耶金先生的对话

“The Person Across from Me is You”: A Record of a Dialogue with Mr. Daniel Yergin

“The Person Across from Me is You《我的对面是你》” is the title of a book by Ambassador Fu Ying傅莹, a renowned Chinese diplomat, former Vice Minister of Foreign Affairs, and former Vice Chairperson of the Foreign Affairs Committee of the National People’s Congress. The book recounts the stories behind the press conferences she hosted.

I am borrowing her title here to record a unique and spirited dialogue I had with Mr. Daniel Yergin, a world-renowned energy strategic thinker and Vice Chairman of S&P Global, at the recently concluded International Energy Executive Forum 2025 (IEEF). This dialogue had been in the works for a long time and served as a key agenda item during the plenary session on the first morning of the forum.

I recall beginning the session as follows:

Lu Ruquan: Distinguished guests, leaders, ladies and gentlemen, good morning! Welcome to the International Energy Executive Forum 2025. In this upcoming segment, we are honored to invite a very important guest: Mr. Daniel Yergin. He will first deliver a keynote speech, followed by a 15-minute dialogue between Mr. Yergin and myself.

I believe you are all as familiar with Mr. Yergin as I am, but I would still like to provide a brief introduction. Mr. Daniel Yergin is a global strategic thinker in the energy sector and the Vice Chairman of S&P Global. At the same time, he is a prolific author of works such as The Prize, The Quest, and The New Map. More importantly, he is the founder of CERAWeek, a highly renowned forum in the energy industry. Now, let us turn the time over to Mr. Yergin.

After Mr. Yergin concluded his keynote speech, which lasted approximately 15 minutes, we proceeded to the dialogue. The following is a record of the full content of our conversation.

Lu Ruquan: Thank you! Mr. Yergin, please remain on stage, as we have a dialogue session scheduled. We have just listened to your brilliant report. I think we can begin our conversation with the energy policies of the Trump 2.0 administration.

We know that Trump is currently re-embracing fossil energy, including oil and natural gas. This implies that in the near future, U.S. oil and gas production is likely to climb further. According to forecasts by S&P Global experts, U.S. export capacity in the liquefied natural gas (LNG) sector could potentially double by 2035, reaching a massive 250 million tonnes.

China, however, is adopting different measures; we place great emphasis on energy transition and electrification. Many experts note that China may become an electrification-led nation in the future, while the U.S. continues to be a major power in oil, gas, and fossil fuels. I would like to ask for your views on this. Are there potential areas where China and the U.S. can carry out energy cooperation in the future?

Daniel Yergin: To answer this briefly: Yes, there are. China is indeed poised to become the dominance of renewable energy and the electrification revolution. The term the current U.S. administration uses is “energy dominance,” which primarily refers to fossil fuels, including oil, gas, and coal.

We are seeing a huge shift in U.S. energy policy, arguably canceling subsidies for the renewable energy industry. However, renewable energy is still growing in the U.S. When some European representatives attended CERAWeek, they pointed this out, noting that they will continue to invest in this sector in the U.S. I believe there is one area of cooperation, namely the LNG sector. I look forward to the issue of U.S.-China trade friction being resolved perfectly. Once resolved, I think the U.S. LNG sector could potentially engage in some cooperation with China.

Lu Ruquan: You just mentioned that the Trump administration wants to restart coal, and the U.S. also reactivated many coal-fired power plants. My question is: What is the situation regarding the overall coal supply chain in the U.S.? Can the U.S. infrastructure and labor force support the Trump administration’s restart of coal power projects?

Daniel Yergin: I think during the Biden administration, the U.S. closed down a lot of coal plants, but this has changed. A concern in the U.S. now is that its power generation capacity is insufficient. The country is very worried about the stability of the power system. This is why it is keeping some coal plants in operation. The current administration likes coal power, and coal is a critical source of electricity.

Lu Ruquan: Does this mean that in the future, there is still some room for the development of coal power in the U.S.?

Daniel Yergin: Yes, speaking of now, the U.S. is still using coal power. The country is very reluctant to shut down these coal plants, even though wind and solar energy are increasing.

There is also natural gas and LNG. By 2030, the U.S. originally intended to sell off all three major natural gas turbine production plants, but it has now halted this transfer agreement. (Note: The three major U.S. gas turbine manufacturers generally refer to GE, Pratt & Whitney, and Honeywell).

Lu Ruquan: It is expected that after the current Trump administration ends, the U.S. will continue to follow Trump’s current policy of retreating to fossil energy. If that is the case, by 2032 — essentially the end of the next administration — the pace of the U.S. energy transition will lag seriously behind Europe and China. If this situation truly arises, can the American people accept it?

Daniel Yergin: I feel you are actually predicting who the next U.S. president will be. We don’t know; we are always prepared for surprises.

I think that while the renewable energy industry has many development opportunities, its development is currently facing severe blows. We in the U.S. need cost advantages. If we want to generate power quickly — for example, solar energy is a very good method — I think it is possible that the U.S. will increase investment in solar energy in the future.

Lu Ruquan: From Mr. Yergin’s response, we can gather that for any energy type, as long as there is a cost advantage, there is a development advantage; cost advantage is a very important consideration. If oil and gas remain relatively cheap after the Trump administration, will this catalyze the re-industrialization of the U.S.?

In China, the government focuses heavily on innovation. The cost of new energy power generation continues to fall; specifically, the costs of wind and solar have dropped by 60% over the past decade. This is why China is vigorously developing wind and solar energy.

Daniel Yergin: I think China has a huge advantage in this regard. You have driven costs down so significantly, and you have large-scale manufacturing.

Lu Ruquan: The next question is about artificial intelligence (AI) You mentioned AI in your keynote speech. We know that AI is now extremely important, arguably embedded in every aspect of life, including the energy sector.

Some of Chinese experts have mentioned that the business model of the AI industry in the U.S. focuses heavily on leading innovation, leading technology, and leading chips, combined with commercial impact. However, China’s model is a bit different: China’s AI model is driven by top-down policy. While China’s chips may not be particularly leading-edge, they can still drive China’s manufacturing sector to maintain its advantage. How do you view the different AI business models of the two countries?

Daniel Yergin: It is very regrettable that the degree of free trade between the two countries is not as high as it used to be. Formerly, free trade increased our transfer and exchange of technology and knowledge. Now, high-end chips are not just a commercial product but also a political product, which is very regrettable.

Competition among major U.S. AI companies is extremely fierce. While the discussion has consistently revolved around competing with China’s AI sector, the reality is that domestic competition within the U.S. is incredibly intense.

The Trump administration has recruited business leaders from Silicon Valley to the White House to oversee the formulation of U.S. AI policy. Reflecting seriously on your question, I believe the integration of government and private enterprise in the AI sector is vital — and this is a major American advantage.

Some U.S. AI companies are strong advocates for scaling. They are not particularly concerned about knowledge or innovation; their primary worry is energy. With the rise of AI, traditional oil and gas resources are regaining favor. This implies that AI companies, which previously never had to consider energy, will focus heavily on this area moving forward.

When ChatGPT burst onto the scene in November 2022, I believe it marked a turning point. It has been only a few years, yet in that short time, we have witnessed tremendous development in AI.

Lu Ruquan: I strongly agree with your point that AI requires massive amounts of electricity. It is understood that in the U.S., natural gas accounts for approximately 40% of power generation, whereas in China, that figure currently stands at perhaps only 4%. What is your outlook on the future of natural gas power generation in China?

Daniel Yergin: I believe you have a better understanding of this issue than I do. China has formulated the "15th Five-Year Plan," which likely contains more specific language regarding natural gas. China possesses a very stable existing energy architecture; coal-fired power accounts for a very significant proportion, and you also place great emphasis on nuclear power and fusion.

In the U.S., many nuclear plants were shut down. The goal now is to reverse this situation and pursue the development of nuclear fusion, which is also a critically important aspect. There are also numerous hydrogen projects — hydrogen can also be utilized for power generation. I recall one hydrogen project with a capacity that appears equivalent to that of 60 nuclear power plants.

Lu Ruquan: Yes, China should certainly learn from the U.S.; there is a need to align with the U.S. in terms of natural gas power generation. Given the time constraints, I will ask one final, simple question: what is your outlook on oil prices for 2026?

Daniel Yergin: If one looks strictly at supply and demand, the conclusion would be that oil prices next year could be $60 per barrel or lower. However, if geopolitical risks are taken into account, prices could be higher. This specifically depends on various geopolitical events, such as the situation in Venezuela recently. If the focus is on price fundamentals, one must look primarily at supply and demand, which I believe offers a clear answer.

Lu Ruquan: Thank you. That forecast appears to align closely with the projections from our Economics & Technology Research Institute at China National Petroleum Corporation (CNPC ETRI).

The Institute predicts that over the next five years, Brent crude prices will experience some volatility, likely ranging between $55 and $65 per barrel, with a more optimistic estimate placing the range at $55 to $70.

Daniel Yergin: I hope so.

Lu Ruquan: Our time for this segment is almost up. Ladies and gentlemen, please join me in giving Mr. Yergin a round of warm applause to thank him for his insights. We have prepared a small gift for Mr. Yergin: an exquisite commemorative plaque bearing his name.

The above concludes the dialogue between myself, Lu Ruquan, and Daniel Yergin. To share the stage with a globally recognized energy strategist and engage in a direct exchange entirely in English was a profound honor — though, I must admit, one accompanied by a sense of trepidation.

“Across from me is you” — on this occasion, the one seated across from me was Mr. Yergin. Of course, at the Opening Plenary Session, facing both Mr. Yergin and myself was also an audience of over 600 distinguished guests. This was my first dialogue with Mr. Yergin, and I trust it will not be the last.

(Saturday, December 20, 2025, at Energy Valley, Future Science City, Beijing)

Below are the most popular posts of this newsletter in 2025. If you enjoy them, a quick like or share really helps new readers find my work!

A practical guide to identify a Chinese official's rank

To make sense of China’s policy decisions, it is necessary to understand the people who make them.

Local governments key to China's macro stimulus policy effectiveness

China passed a new law today to reassure private entrepreneurs and encourage their investment and operations. From the perspective of your host, the most intriguing party in interactions with private enterprises in China is the local government.

The governance logic of primary-level China (book excerpt)

In case you missed the piece I shared a few months ago by Prof. Nie Huihua(聂辉华): he used hierarchy and incomplete contracts to explain why Chinese local governments often "ratchet up" enforcement by adding their own, stricter rules (层层加码). It's a sharp read and I highly recommend it.