Zhang Bin says China's top response to weak demand should be forceful counter-cyclical policy

After weighting drivers of consumption, the senior fellow at Chinese Academy of Social Sciences argues no other policy can deliver such rapid short-term gains -- only counter-cyclical measures can.

Zhang Bin 张斌 is a Senior Fellow at Institute of World Economics and Politics, Chinese Academy of Social Sciences, and a non-resident senior fellow at China Finance 40 Forum (CF40).

On June 15, at the 40th Cheng Ze forum承泽论坛 hosted by Peking University's National School of Development, he delivered a talk that the organizers have recently published on their WeChat account.

This year has produced a flood of proposals to "boost consumption" and "expand domestic demand." Dr. Zhang's point of departure is to impose discipline on that sprawl: policies have weights, and the first task is to rank the drivers that matter most.

Against the view that China's demand shortfall is chiefly structural or confidence-driven — hence the call for instant cash handouts or sweeping SOE profit transfers — Zhang argues the current drag is predominantly cyclical and thus policy-contingent.

In a simple scenario, lifting the GDP deflator from roughly −0.7% to about 2% and allowing real output to respond could add around 4.2 percentage points to consumption growth without touching grand reforms. Priority One, therefore, is counter-cyclical policy now: lower policy rates, expand public investment, and deploy targeted consumption subsidies.

From study to strategy, Zhang sets three principles: local-first (minimize coordination costs and approval layers to ensure implementable pilots), incremental-first (use new increments to unlock space before tackling stock), and effectiveness-first (pick reforms with the highest lift on the consumption share or household income).

On that basis he orders the agenda: 1) counter-cyclical policy; 2) raise household propensity via pro-family measures, metropolitan-area building, and real settlement pathways for migrant workers; 3) strengthen secondary distribution — welfare and social insurance, with redistribution when timing permits; 4) improve consumer-facing finance, including credit access, equity dividends, pension finance, to ease liquidity constraints; 5) industrial policy that unlocks services and ends local subsidy races, supporting better primary distribution over the medium term.

Below is the translation of his speech, and all the words in bold are added by me. The translation has not been reviewed by Mr. Zhang.

张斌:影响消费的关键力量与扩消费的重要原则

Zhang Bin: The Key Forces Shaping Consumption and the Guiding Principles for Expanding It

In recent years, especially this year, consumption has become a central concern in academia and government. In March 2025, the General Office of the Communist Party of China Central Committee and the General Office of the State Council issued the Special Action Plan to Boost Consumption. The plan comprises seven major action packages plus one auxiliary package, totaling 30 priority tasks and further broken down into more than 100 concrete items. It is a highly systematic, all-in-one package that touches almost every consumption-related dimension: supply and demand, short-term policy and medium- to long-term reform, localized frictions and system-wide shifts.

Clearly, those 100-plus tasks cannot all advance at once; trade-offs are unavoidable and priorities must be set. As Mao Zedong put it in On Contradiction《矛盾论》: "Do not try to solve all problems at once; behind every problem there are more problems." We therefore need to identify and address the principal contradiction first.

Many propose expanding cash transfers to households as part of income-distribution reform; others advocate raising property income by channeling more state-owned enterprise profits to the public. Suggestions abound. Yet, after a careful look at the factors that actually determine consumption in China, we may no longer cling to earlier views, because these factors do not carry equal weight.

What, then, is the principal contradiction in boosting consumption? Given finite administrative bandwidth and resources, where should we start? What deserves emphasis? Our study begins here: to pinpoint the fundamental forces that drive changes in consumption.

I. Investigating the decisive forces behind consumption

To understand the forces behind China's consumption, we should look not only at what has mattered historically but also at each force's potential going forward.

On that basis, we should next distinguish which forces will be propelled by market self-adjustment, i.e., where the market will do the work even without government intervention. For example, I can say with confidence that China's consumption share will rise over time even if no policies are enacted, because market forces are already pushing in that direction.

We should also identify forces amenable to policy leverage, and weigh the feasibility of reform. Not all reforms are easy to implement, nor can they be willed into being. We must evaluate which policy changes are more executable and face less resistance.

Only by weighing all these considerations can we identify points of departure and breakthrough.

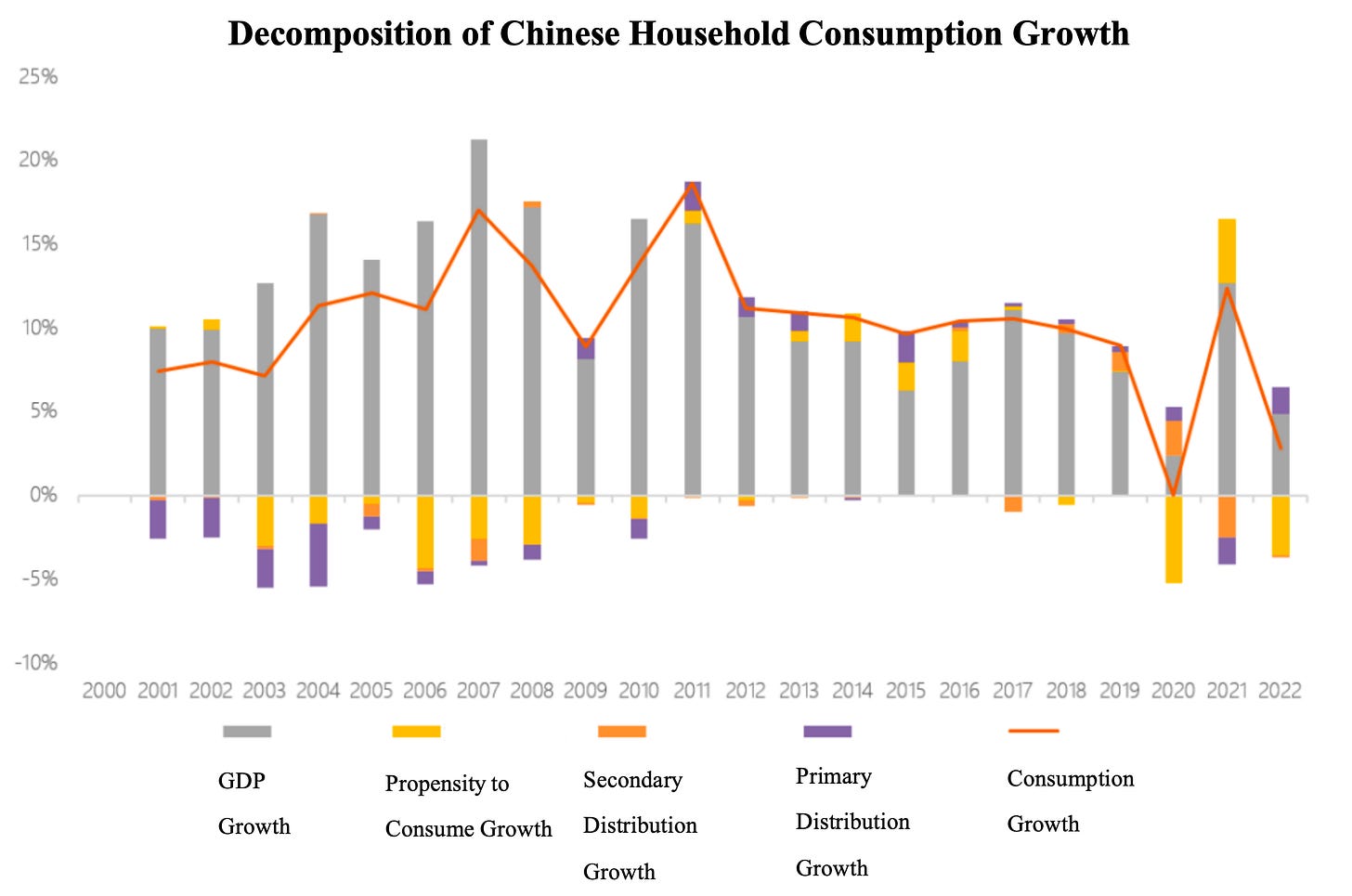

To get a firm grip on the drivers, intuition is not enough, and we also need data. How do we "let the data talk"? The key is to decompose consumption.

Consumption can be decomposed into four parts:

Total income, i.e., the income created nationwide each year.

Primary distribution, i.e., the share of primary income that accrues to consumers.

Secondary distribution, i.e., the disposable income of the household sector after taxes and transfers.

Propensity to consume, i.e., how much is spent given disposable income.

With this four-part decomposition, we can use historical data to see which factors have mattered most for consumption.

Figure 1 shows that the pace of GDP growth directly shapes the pace of consumption growth; therefore, total income (GDP) has the largest impact on consumption. The second-largest influence is the propensity to consume, followed by primary income distribution, and lastly secondary distribution. These are conclusions drawn from past data.

After mapping the components, we must further unpack the forces behind them. GDP growth is driven by industrial development and productivity advances, and it is also significantly affected by the business cycle. Primary distribution is closely tied to industrial structure, while secondary distribution reflects tax policy and social welfare programs. The propensity to consume is influenced by multiple factors as well.

In short, the decisive forces behind consumption include: industrial forces, cyclical forces, corporate governance and financial policies, tax policy plus social welfare and social security, as well as other policies.

II. The power of industry: the dominant force behind long-term changes in consumption

Industrial forces dominate long-run shifts in consumption. Going forward, China's industrial upgrading will affect consumption through two intertwined channels. First, as upgrading proceeds, overall growth will naturally moderate, which tends to slow consumption growth. Second, upgrading will gradually shift the industrial structure from industry toward services. Before per-capita income reaches 20,000 US dollars, this shift tends to improve primary income distribution, thereby supporting consumption growth.

III. The power of the cycle: the decisive force in certain periods

Cyclical forces should not be underestimated. The main reason consumption growth has been weak in recent years is precisely the cycle. From a cyclical perspective, fluctuations in consumption growth can be sizable; growth of 3%, 4%, or 5% can all be explained by cyclical forces.

Consider a scenario analysis. Suppose the GDP deflator is currently at −0.7%. If it moves up to 2%, that would indicate broad balance between supply and demand, with no shortfall in demand. If the GDP deflator rises to 2%, nominal GDP growth would accelerate from −0.7% to 2%, a gain of 2.7 percentage points. And that is not all: stronger demand would also lift real output, by roughly 1.5 percentage points, as historical patterns suggest. Taken together, consumption would rise by about 4.2 percentage points.

This implies that even without undertaking structural reforms or reforming state-owned enterprises, counter-cyclical measures alone, such as fully lowering policy rates and increasing public investment, could lift the consumption rate by about 4.2 percentage points within a year. No other policy can deliver such rapid consumption gains in the short run; only counter-cyclical policy can. I want to underscore this point.

In addition, deeper financial markets can ease liquidity constraints and raise property income; and secondary distribution will be pivotal for boosting the propensity to consume in the future. These two forces are also important but are not elaborated here.

IV. Principles and sequencing for policies to expand consumption

Reform should not proceed blindly; it must respect constraints. To advance reforms effectively, three basic principles matter.

First, the principle of "local first." Keep the number of departments and policies involved to a minimum, streamline approvals as much as possible, and limit the need for complex institutional complements — so reforms can land smoothly.

Second, the principle of "increments first." Start with incremental measures; use the newly created policy space to unlock stock adjustments.

Third, the principle of policy efficacy. Prioritize reforms with the strongest effect on the propensity to consume or on the household share of income.

Based on these principles, an advisable sequence for expanding consumption is:

Counter-cyclical policies. These most quickly lift household income and expectations in the short run, thereby expanding consumption. Key tools include fully lowering policy rates, scaling up public investment, and providing consumption subsidies.

Policies to encourage childbirth, build metropolitan areas, and help migrant workers settle in cities. These reforms can raise the propensity to consume for specific groups and merit vigorous, localized pilots in the near term.

Secondary distribution policies. This includes strengthening social welfare and social security. It is the key pillar for boosting the propensity to consume over the medium to long term and requires sustained effort. Secondary distribution also covers policies to adjust income and wealth distribution; such reforms should be advanced when conditions are ripe.

Policies to improve household-facing financial services. This includes supporting consumer credit, boosting equity dividend payouts, and developing pension finance. The goal is to cultivate financial markets so that market forces can raise household income and security, ease liquidity constraints, and support consumption.

Industrial policy. The focus is to unlock the potential of services and remove local subsidies. These steps can strengthen economy-wide income growth, improve primary distribution, and underpin medium- to long-term consumption growth. Because they implicate numerous reforms, including sectoral governance, public institutions, and local-government functions, pilot breakthroughs are needed. Enditem

No surprises here. Most of this long-winded discussion seems non-controversial (though detailed proposals or changes are lacking). I’m confident the government is working on many of these ideas and others. I’m not sure why this article was features for translation.